|

Sunday, April 28, 2024

|

GiftLaw Pro |

|

GiftLaw Note:

ORG is a private foundation under Sec. 501(c)(3) of the Code. ORG's purpose is to donate funds to different charitable organizations and government entities in order to further education, human culture and history, research of human diseases and protection of the natural environment. ORG's two directors, officers and sole contributors are DIR-1 and his wife DIR-2. They have two children RA-1 and RA-2. DIR-1 and DIR-2 are also the sole managers and owners of Companies 4 and 5. The main disbursements of ORG during its existence were for "Outside Services" paid to RA-1 and RA-2. ORG provided no substantiation in the form of invoices, agreements for services or reports describing the work performed and hours worked. In addition, an unsecured and interest-free loan was made from ORG to Company 5. Also, several loans with interest rates below fair market value were extended to Company 4.

To qualify for tax-exempt status under Sec. 501(c)(3) of the Code, no part of the net earnings of a tax exempt entity may inure to the benefit of any private shareholder or individual. Section 1.501(a)-1(c) defines a private shareholder or individual as a person having a private interest in the activities of an organization; in general, a person who is an "insider" with respect to the organization. In John Marshall Law School and John Marshall University v. United States, the Service determined that the law school and university were not tax-exempt entities since expenditures made for the benefit of the founding family were not ordinary and necessary expenses in the course of the schools' operations. Here, the Service determined that by making payments to RA-1 and RA-2 and loaning money to Companies 4 and 5, ORG served the interests of DIR-1 and DIR-2 instead of charitable interests. Therefore, the Service revoked ORG's exempt status.

|

December 27, 2013 PLR 201351026 IRS Rules Foundation Not Tax Exempt

12/20/2013 (09/24/2013)

Dear * * *,

We have enclosed a copy of our report of examination explaining why we believe revocation of your exempt status under section 501(c)(3) of the Internal Revenue Code (Code) is necessary.

If you accept our findings, please sign and return the enclosed Form 6018, Consent to Proposed Adverse Action. We will send you a final modification or revocation letter.

If you do not agree with our proposed revocation, you must submit to us a written request for Appeals Office consideration within 30 days from the date of this letter to protest our decision. Your protest should include a statement of the facts, the applicable law, and arguments in support of your position.

An Appeals officer will review your case. The Appeals office is independent of the Director, EO Examinations. The Appeals Office resolves most disputes informally and promptly. The enclosed Publication 3498, The Examination Process, and Publication 892, Exempt Organizations Appeal Procedures for Unagreed Issues, explain how to appeal an Internal Revenue Service (IRS) decision. Publication 3498 also includes information on your rights as a taxpayer and the IRS collection process.

You may also request that we refer this matter for technical advice as explained in Publication 892. If we issue a determination letter to you based on technical advice, no further administrative appeal is available to you within the IRS regarding the issue that was the subject of the technical advice.

If we do not hear from you within 30 days from the date of this letter, we will process your case based on the recommendations shown in the report of examination. If you do not protest this proposed determination within 30 days from the date of this letter, the IRS will consider it to be a failure to exhaust your available administrative remedies. Section 7428(b)(2) of the Code provides, in part: "A declaratory judgment or decree under this section shall not be issued in any proceeding unless the Tax Court, the Claims Court, or the District Court of the United States for the District of Columbia determines that the organization involved has exhausted its administrative remedies within the Internal Revenue Service." We will then issue a final revocation letter. We will also notify the appropriate state officials of the revocation in accordance with section 6104(c) of the Code.

You have the right to contact the office of the Taxpayer Advocate. Taxpayer Advocate assistance is not a substitute for established IRS procedures, such as the formal appeals process. The Taxpayer Advocate cannot reverse a legally correct tax determination, or extend the time fixed by law that you have to file a petition in a United States court. The Taxpayer Advocate can, however, see that a tax matter that may not have been resolved through normal channels gets prompt and proper handling. You may call toll-free 1-877-777-4778 and ask for Taxpayer Advocate Assistance. If you prefer, you may contact your local Taxpayer Advocate at:

If you have any questions, please call the contact person at the telephone number shown in the heading of this letter. If you write, please provide a telephone number and the most convenient time to call if we need to contact you.

Thank you for your cooperation.

Sincerely,

Nanette M. Downing

Director

EO Examinations

ISSUES

1: Whether the ORG is operating exclusively for public and charitable purposes as described in Internal Revenue Code (IRC) Section 501(c)(3) with no part of its net earnings inuring to the benefit of any private shareholders or individuals?

2. Whether the ORG should be assessed penalties for failure to file correct information on Form 990-PF for years ending November 30, 20XX and November 30, 20XX as provided by IRC 6652(c)(1)(A)(ii)?

FACTS

Organization and Structure of ORG

ORG (the "Foundation") was formed Dec. 21, 20XX and received Internal Revenue Service ("IRS") private foundation ruling and exemption from federal income tax under IRC Section 501(c)(3) on IRS letter dated February 27, 20XX.

Foundation's Articles of Incorporation state its specific purpose: to donate available funds for research and development, for community benefits and performance of arts, and for developing philanthropic missions. These include IRC 501(c)(3) clauses that prohibit inurement of any part of the net income or assets of the Foundation to any director, officer, or any other private person.

Foundation's Application Form 1023:

Around Dec. 22, 20XX the Foundation applied to IRS for exemption under IRC 501(c)(3) and its application Form 1023 informed the IRS that its proposed activities will be making grants: * * *% for education, (the grantees will be schools), * * *% for human culture and history (the grantees will be Country and Country Performance Arts, and science museums), * * *% for research of human diseases -- (the grantees will be the CO-1, Cancer research, and AIDS vaccine initiative in State), and * * *% for protecting the natural environment -- the planned beneficiaries for this activity were the CO-2 and the CO-3.

The application Form 1023, Pages 4, 5, asked if the Foundation has or it will have financial transactions with its officers, etc, particularly if it will purchase any services from them, if it has or it will have any loans, contracts or other agreements with them, and if it has or will have any leases, contracts, loans or other agreements with any organization in which any of its officers are also officers or directors, or in which its officers have more than * * *% ownership. The Foundation replied it will not have any such transactions.

Foundation's Activities as disclosed on its 990-PF Information Returns

Foundation's fiscal year ends in November. Foundation's annual returns Forms 990-PF were usually filed by the due date for filing those returns: (the fifteen day of the fifth month that followed the end of Foundation's fiscal year). Foundation's annual returns 990-PF reported that during the years ending Nov. 30, 20XX ("20XX11") through Nov. 30, 20XX ("20XX11") it had not engaged in activities that have not been previously reported to the IRS. It also reported that DIR-1 and DIR-2 became its substantial contributors. The Foundation reported on its Forms 990-PF that it is not claiming to be a private operating foundation within the meaning of IRC 4942(j)(3).1

Foundation's Substantial Contributors and its Affiliated Entities:

The Organization's two directors and officers are DIR-1 and his wife DIR-2 (the "DIR's family"). They are the only contributors to the Foundation and became the Foundation's Substantial Contributors since its first year. They have two children: RA-1 (born April 19XX) and RA-2 (born April 19XX). The officers are the sole managers and owners of CO-4 (the "LLC"). DIR-1 is the sole owner of CO-5

Foundation's transactions with the DIR's family as reported on its annual returns 990PF

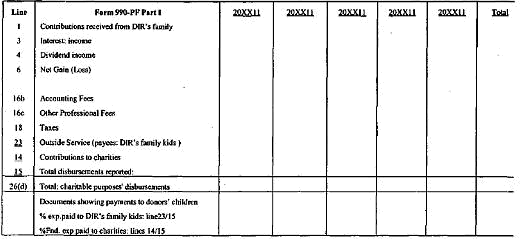

Table A

Disclosure of Foundation's activities in its minutes:

Foundation's minutes reported its board's meetings deliberations held at the DIR's family home. The minutes taken in the year 20XX11 (dated Nov. 22, 20XX) show that the officers (President DIR-1 and Treasurer-Secretary DIR-2) discussed compensation issues and they resolved that the Foundation will not compensate them for their services. They also resolved to continue to pay outside services to promote environmental care in the community. Similar resolutions were made during the meeting they had in year 20XX11 (dated Nov. 13, 20XX). In the year 20XX11 (meeting dated Nov. 21, 20XX) they resolved that the outside services program to promote environmental care in the community will end the following year.

The minutes did not describe what services or work was required from the outside service program providers. No competing bids process for the outside service providers' fee was reported, and there was no information who these people are or their professional qualifications and compensation information. The minutes did not discuss annual raises to those providers. Foundation's minutes also did not discuss the loans that the Foundation made to its officers' owned entities or if they will pay any interest.

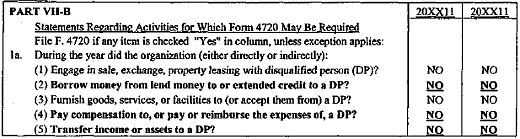

Disclosure of Foundation's transactions with its Disqualified Persons on Forms 990-PF

The Foundation's replies to questions on Part VII-B "Statements regarding activities for which form 4720 may be required" were "no" to all the questions about loans and payment of compensation to disqualified persons as shown in Table B (see 990-PF Part VII-B pg. 5):

Table B

The Instructions to Form 990-PF for the year 20XX11 (page 3-see Attachment B) explain that the definition of disqualified person includes: persons who are substantial contributors to the Foundation, their children, and any corporation or a partnership in which they own a total beneficial interest of more than * * *%, as quoted from those instructions:

"A disqualified person is any of the following:

a. A substantial contributor (see instructions for Part VII-A, line 10, on page 19).

b. A foundation manager.

d. A family member of an individual described in a, b or c above.

e. A corporation, partnership, trust, or estate in which persons described in a, b, c, or d above own a total beneficial interest of more than * * *%."

Foundation's Substantiation of payments it made for Outside Services:

The main disbursements of the Foundation during its existence were for "Outside Services" that were paid to RA-1 and RA-2. IRS requested that the Foundation will substantiate the business purposes of these transactions. IRS' Form 4654 Information Document Request ("IDR") #002 dated Sept. 8, 20XX asked the Foundation to provide all contracts to which it was a party in the year ending Nov. 30, 20XX (item 2) -- the reply was that the Foundation had no contacts that year.

IDR #003 (item 10) asked for invoices and similar records that explain and document (substantiate) the business purposes of Foundation's disbursements (expenses) of $* * * or larger it spent in year ending Nov. 30, 20XX. Additionally, Item 11a specifically requested information and documentation (invoices, contracts, etc.) that substantiates the business purpose of Foundation's payments to the Outside Service providers RA-1 and RA-2.

The Foundation provided no substantiation in form of invoices, agreements for services, or any reports describing the work or services they provided and the hours they worked. IRS requested similar explanation and documentation of the services RA-1 and RA-2 provided the Foundation during the year 20XX11 (see IDR 005 -item 1, and IDR 004 (items 6, 8, 9). The Foundation did not provide any records that substantiated services RA-1 and RA-2 provided to the Foundation in year ending Nov. 30, 20XX.

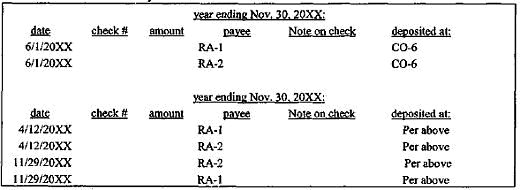

Table C: Foundation's Payments to RA-1 and RA-2

in 20XX11 and 20XX11:

During the initial interview DIR-1 was asked to explain what services RA-1 and RA-2 provided to the Foundation, what was the basis for the Foundation's payments it gave them, if they had to report work they did, the number of hours they worked, if he supervised their work, if they demanded a pay for any type of services and when they started working for the Foundation.

DIR-1 said that the payments were not made as fee for services, that RA-1 and RA-2 received $* * * in year 20XX11 for helping in recycling program where they explained to people how recycling works. He said that RA-1 and RA-2 worked when they went with their mother to open houses (her resume shows she id is a real-estate agent), he did not supervise them or see them work, they did not ask for payment, there were no reporting requirements, and there are no records documenting the work they did. He decided to pay the children to ensure the children have some income but there were no set work responsibilities they had to do.

Foundation's Loans to Affiliates -- entities owned by its Substantial Contributors:

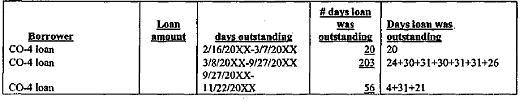

In its fiscal year ending Nov. 30, 20XX, on or around April 23, 20XX, the Foundation lent $$* * * from its CO-7 Business Checking ## to CO-5 the loan was repaid on June 1, 20XX (the $$* * * was deposited to Foundation's CO-7 Account ##). The loan was not made subject to a written agreement and was not secured. The loan was interest free. In fiscal year ending Nov. 30, 20XX Foundation made several loans to CO-4s LLC. These were made from Foundation's CO-7 Account ## in several payments as noted in Table D:

Table D

The LLC repaid the loan of $* * * on 11/23/20XX to Foundation's account ##. Foundation's loans to the LLC were not made subject to a written agreement and were not secured. The LLC paid the Foundation interest: $* * * and additional $* * * were paid on April 8, 20XX and June 1, 20XX respectively (deposited to Foundation's Account ##). The approximate annual percentage rate paid by the LLC was * * *% as calculated on Attachment A. In both 20XX and 20XX the Federal Reserve Board Prime Rate was * * *%. Thus the interest rate on the loans was below ("FMV") of 3.25% exemplified by the Federal Reserve Board Prime Rate (Attachment C).

LAW: ISSUE 1

a. Requirement for Exemption under IRC 501(c)(3)

Section 501(c)(3) of the Internal Revenue Code provides for the exemption from federal income tax of organizations that are organized and operated exclusively for charitable purposes, no part of the net earnings of which inures to the benefit of any private shareholder or individual.

Section 1.501(c)(3)-1(a)(1) of the Income Tax Regulations provides that an organization must be both organized and operated exclusively for one or more of the purposes specified in section 501(c)(3) of the Code in order to be exempt as an organization described in such section.

Section 1.501(c)(3)-1(c)(1) of the regulations provides that an organization will be regarded as "operated exclusively" for one or more exempt purposes only if it is engaged primarily in activities that accomplish one or more of such exempt purposes specified in section 501(c)(3). An organization will not be so regarded if more than an insubstantial part of its activities is not in furtherance of an exempt purpose.

Section 1.501(c)(3)-1(c)(2) of the regulations provides that an organization is not operated exclusively for one or more exempt purposes if its net earnings inure in whole or in part to the benefit of private shareholders or individuals.

Section 1.501(c)(3)-1(d)(ii) of the regulations states that an organization is not organized or operated for one or more exempt purposes unless it serves a public rather than a private interest. Accordingly, it is necessary for an organization to establish that it is not organized or operated for the benefit of private interests such as designated individuals, the creator, shareholders, or persons controlled, directly or indirectly, by such private interests.

Treas. Reg. § 1.501(a)-1(c) defines a private shareholder or individual as those persons having a personal and private interest in the activities of an organization. In general, a private shareholder or individual is considered an "insider" with respect to the exempt organization.

b. Case: Existence of a substantial non-exempt Purpose, can Destroy Exemption under 501(c)(3)

Better Business Bureau v. United States, 316 U.S. 279 (1945), holds that the existence of a single non-exempt purpose, if substantial in nature, will destroy the exemption under section 501(c)(3). An organization will be regarded as operated exclusively for one or more exempt purposes only if it engages primarily in activities that accomplish one or more of such purposes.

c. Cases: Exemption under 501(c)(3) was revoked due to Inurement or Private Benefit

Unitary Mission Church of Long Island, Petitioner v. Commissioner of Internal Revenue, Respondent 74 TC 507, Filed June 3, 1980 -- The court found: "Net earnings benefited private individuals.] -- Petitioner's financial decisions are controlled by X, one of petitioner's ministers, and his wife. X received widely fluctuating 'parsonage allowances' over a three year period as compensation for leading Sunday services and for being available for pastoral counseling. There is no evidence in the administrative record of any differing duties that he performed over these years. . . . Held, petitioner is not entitled to exemption from Federal taxation under secs. 501(a) and 501(c)(3), I.R.C. 1954, as amended, because a part of its net earnings inures to the benefit of private shareholders or individuals".

People of God Community, Petitioner v. Commissioner of Internal Revenue, respondent 75 TC 127, Filed October 14, 1980 -- The tax court decided that a portion of gross earnings inured to the benefit of private shareholders or individuals. The court stated:

"An organization will qualify under section 501(c)(3) only if (1) it is organized and operated exclusively for exempt purposes, (2) no part of its net earnings inures to the benefit of any private shareholder or individual, and (3) it devotes no substantial part of its activities to political or lobbying activity. . . . we will confine our discussion herein to the private inurement issue. . . .

. . . The burden falls upon petitioner to establish the reasonableness of the compensation paid to Donhowe and petitioner's other ministers. Bubbling Well Church of Universal Love Inc. v. Commissioner [Dec. 36,999], 74 T.C. 531 (1980). Petitioner has failed to do so inasmuch as the record on this point contains little more than conclusory assertions and the fact that Dowhowe's compensation was partly based on his personal needs. Moreover, the method by which ministers' compensation was determined shows clearly that a part of petitioner's net earnings was paid to private shareholders or individuals."

In P.L.L. Scholarship Fund v. Commissioner, 82 T.C. 196 (1984), the Tax Court concluded that an organization that raised funds for charity by conducting bingo games in a bar owned by the organization's directors had the substantial private purpose of making food and beverage sales for the benefit of the bar's owner. On this basis, the Court concluded that the organization could not qualify for exemption under section 501(c)(3).

In Wendy L. Parker Rehabilitation Foundation, Inc. v. Commissioner of the IRS T.C. Memo. 1986-348, the Tax Court upheld the IRS' position that a foundation formed to aid coma victims, including a family member of the founders, was not entitled to recognition of exemption. Approximately * * *% of the organization's net income was expected to be distributed to aid the family coma victim. The Court found that the family coma victim was a substantial beneficiary of the foundation's funds. It also noted that such distributions relieved the family of the economic burden of providing medical and rehabilitation care for their family member and, therefore, constituted inurement to the benefit of private individuals.

In John Marshall Law School and John Marshall University v. United States, 81-2 USTC 9514 the Plaintiffs, law school and college, petitioned for a declaratory judgment under I.R.C. § 7428(a)(1)(A) (1954) to overturn the Internal Revenue Service's determination that they were not entitled to tax-exempt status for the years 1967-1973.

The law school and the college argued that they qualified for exemption under I.R.C. § 501(c)(3). Defendant United States responded that they should be denied exempt status because part of their net earnings inured to the benefit of private shareholders or individuals. The law school and the college paid for the founding family's automobiles, education, travel expenses, insurance policies, basketball and hockey tickets, membership in a private eating establishment, membership in a health spa, interest-free loans, home repairs, personal household furnishings and appliances, and golfing equipment. The court determined that the Internal Revenue Service's revocation of the law school's and the college's notices of exemption for the years 1967 through 1973 was correct because the expenditures for the founding family were not ordinary and necessary expenses in the course of the law school's and the college's operations

ISSUE 1

1: Whether the ORG is operating exclusively for public and charitable purposes as described in Internal Revenue Code (IRC) Section 501(c)(3) with no part of its net earnings inuring to the benefit of any private shareholders or individuals?

TAXPAYER'S POSITION

Is yet to be received.

GOVERNMENT'S POSITION

The government contends that ORG failed the operational test of 501(c)(3) as it was not operating exclusively for charitable purposes, first, its earnings inured to the benefit of private persons or its shareholders, and second, its operations served substantial private interests:

First: Foundation's earnings inured to the benefit of its private shareholders, and thus it did not operate exclusively for one or more exempt purposes as required under Treas. Reg. 1.501(c)(3)-1(c)(2). Foundation's shareholders are DIR-1 and his wife DIR-2, as they meet the definition of being shareholders and insiders under Treas. Reg. § 1.501(a)-1(c) because they are the insiders of the Foundation since they are the only persons on its Board and they control the Foundation financially -- they contribute all its income and DIR-1 signs Foundation's checks.

The government argues that Foundation's earnings inured to its insiders because during its first five years -- out of the total disbursements it made of $$* * * -- representing * * *% of these disbursements were paid to its shareholders' children: RA-1 and RA-2. Although the payments were stated to be for their services of promoting environmental care -- the services they provided could not be verified because these were not made under written contracts or written requirements that they provide any specific services or set hours, there were no reporting requirements, and the transactions were not established as fee for service for any specific hourly rate. Additionally, they received varied amounts $* * * in 20XX11 to $* * * in 20XX11, and there was no explanation, substantiation or accountability of any differing work duties.

During these years, Foundation's reporting to the IRS on its 990-PF was that its activities as reported previously on its Form 1023 were unchanged, which meant its only activities were grant making. As an organization whose sole activity is grant making it did not need any services from RA-1 and RA-2 because signing checks was the responsibility of DIR-1.

During the year 20XX11 RA-1 was approx. 15 years old and RA-2 was 13 years old. Thus, they were minors, and therefore their parents were responsible to provide for their needs. When the Foundation paid the insiders' children compensation, the decision was made by the Foundation's officers who were their parents. As explained by the court in the case of Wendy Parker -- when a charitable Foundation made cash distribution for the benefit of the child of the persons who controlled it, the transaction constituted inurement of its earnings because: "such distributions relieved the family of the economic burden of providing for their family member and, therefore, constituted inurement to the benefit of private individuals".

Further, as explained, the Foundation's payments to the DIR's family children without accountability and substantiation and without any explanation as to the increased pay -- ($* * * in year 20XX11, $* * * years 20XX11 and 20XX11, and $* * * in year 20XX11) are transactions comparable to those discussed in the cases of: Unitary Mission Church of Long Island, Petitioner v. Commissioner of Internal Revenue, and People of God Community, Petitioner v. Commissioner. In the later case the court noted: "The burden falls upon petitioner to establish the reasonableness of the compensation paid to Donhowe and petitioner's other ministers. . . . Petitioner has failed to do so inasmuch as the record on this point contains little more than conclusory assertions and the fact that Dowhowe's compensation was partly based on his personal needs. Moreover, the method by which ministers' compensation was determined shows clearly that a part of petitioner's net earnings was paid to private shareholders or individuals." similar conclusion was reached by the court in the John Marshall Law School: earnings inured to its founding family because it made expenditures for the family that were not ordinary and necessary expenses in the course of the law school's and the college's operations.

The government contends that Foundation's loan transactions with for profit entities owned by its officers also caused its assets to inure to the benefit of its private shareholders, based on the ruling of the John Marshall Law School where its founders were found to cause that entity's assets to inure to the benefit of its insiders by making interest free loans to their family and the loans and other inurement transactions disqualified that organization for exemption under IRC 501(c)(3). As Table D shows, the loan of $* * * was outstanding for 203 days in year 20XX11 and the Foundation then also had a loan of $* * * that was outstanding for 56 days. These loans used substantial portion of the Foundation's assets for the benefit of its insiders' owned businesses, which show that Foundation's activities served their private interests to a substantial degree.

Because Foundation's transactions of paying the insiders' children for unsubstantiated and unnecessary services was substantial -- it amounted to X% of the total disbursements the Foundation made in its first five years, and because it also made unsecured below market interest loans that used $* * * of its total capital for 202 days and $* * * of its capital for 56 days in 20XX11 (its end of the year capital was $* * *), it served the interests of the insiders and the founders of the ORG to a substantial degree, therefore, as provided by Treas. Reg. Section 1.501(c)(3)-1(d)(ii) -- the Foundation failed to operate exclusively for charitable purposes, and as provided by the Better Business Bureau, the existence of a single non-exempt purpose, if substantial in nature, will destroy exemption under IRC 501(c)(3).

CONCLUSION

As described above, ORG's exemption as an organization described under section 501(c)(3) should be revoked effective December 1, 20XX, because it did not operate exclusively for 501(c)(3) exempt purposes. Its assets inured to private shareholders and its activities served substantial private interests of its shareholders DIR-1 and his wife DIR-2. Form 1120 US Income Tax Return should be filed for tax years ending November 30, 20XX forward. Subsequent returns are due no later than the 15th day of the 3rd month following the close of the Corporation's accounting period. Returns should be sent to the following mailing address:

LAW ISSUE 2

Section 6652(c)(1)(A)(ii) imposes a penalty for a failure to include any of the information required to be shown on a return filed under section 6033 or section 6012(a)(6) or to show the correct information -- "There shall be paid by the exempt organization $20 for each day during which such failure continues. The maximum penalty under this subparagraph on failures with respect to any return shall not exceed the lesser of $10,000 or 5 percent of the gross receipts of the organization for the year."

TAXPAYER'S POSITION

Is yet to be received

GOVERNMENT'S POSITION

The Government contends that ORG failed to report correct information about the transactions it had with its Disqualified Persons on its annual returns Form 990-PF it filed for the years ending Nov. 30, 20XX and Nov. 30, 20XX -- as explained below:

Foundation's said returns Forms 990-PF failed to report Foundation's loans transactions it made to disqualified persons -- CO-5 and the LLC -- those are entities where Foundation's substantial contributors had ownership interests greater than * * *%. Additionally, the said returns Forms 990-PF failed to disclose the payments Foundation made to disqualified persons -- RA-1 and RA-2 who are family members of its substantial contributors.

As explained in Form 990-PF instructions, the definition of disqualified person includes substantial contributors, their family members, and a corporation or partnership in which they have ownership interest greater than * * *%.

Therefore the Foundation had to answer "yes" (rather than "no") to question (2) on Part VII-B that asked if it "lend money to a disqualified person?" because it lent money to disqualified persons CO-5 in year ending Nov. 30, 20XX and it lent money to disqualified person CO-4s, LLC in year ending Nov. 30, 20XX.

Similarly, the foundation had to answer "yes" to question (4) or (5): if it either: "(4). Pay compensation to a disqualified person?" or "(5) Transfer income or assets to a disqualified person?" because the Foundation paid RA-1 and RA-2 money either as compensation or as a transfer of income or assets.

The government contends that based on the above Foundation reported incorrect information to the IRS on its said returns 990-PF for 20XX11 and 20XX11 and as provided under Section IRC 6652(C)(1)(a)(ii) the Foundation should be assessed penalty of no more than $* * * for the incorrect reporting on its 990-PF for the year ending Nov. 30, 20XX, and it should be assessed penalty of no more than $* * * for the incorrect reporting on its 990-PF for the year ending Nov. 30, 20XX. The penalty is computed as follows:

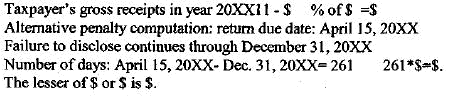

Year 20XX11:

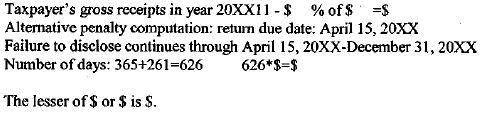

Year 20XX11:

|

|

|

|